When it Comes to Dermatology Billing, How Healthy Is Your Practice?

Four steps to start measuring your medical billing performance

Medical billing represents one of the most critical aspects of a practice, impacting revenue, cash flow and overall financial success. Yet many physicians don’t have a clear understanding of their dermatology medical billing performance and, more importantly, how it affects their bottom line.

By monitoring and reporting on key aspects of your dermatology medical billing operations, you’ll be able to better assess the “health” of your practice and make necessary changes to improve your results.

The Importance of Medical Collections

When it comes to measuring business success, many physicians focus on profitability. While it’s fairly easy to determine your profitability (revenue – expenses = profit), it’s critical—and more difficult—to review your overall medical billing performance metrics, which directly correlate to your revenue. You and your staff may look at provider productivity (patient appointments and charges) as one medical billing metric, but that does not tell the whole story.

Collections are a key part of the equation. This is the measure that tells you whether or not you are being paid successfully for your services. Specifically, your collections provide an indication whether charges are being billed correctly, being processed by payers and being paid in a timely manner. This directly impacts the revenue factor in the profitability formula above. Unfortunately, for many practices, collections often go unmeasured, leaving you without a clear picture of how well you’re really doing in terms of cash flow and profitability.

Whether you use a professional medical billing service or manage it in-house, it’s imperative to measure the performance of the team responsible on a monthly basis. It can be difficult to know the right questions to ask or which reports to review to fully understand and measure your dermatology billing performance. This post will provide a step by step guide on how to get started on measuring your medical billing performance.

How to Start Measuring Medical Billing Performance

While a deep analysis may require the knowledge of a medical billing expert, there are steps you can take to complete an initial assessment of your dermatology billing performance, as outlined below:

Step 1: Pull Data From Financial Reports

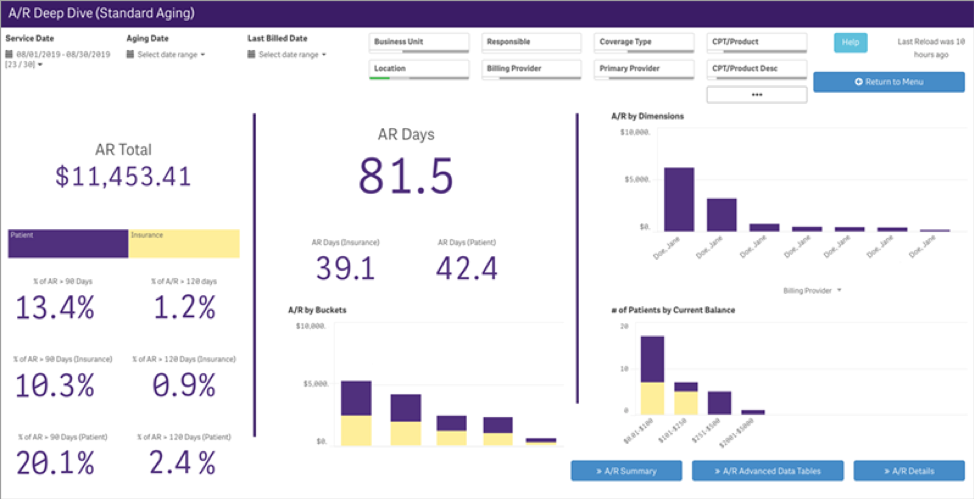

Many practices struggle with measuring metrics because they don’t know what data to pull. Many dermatology practice management systems today have performance reporting tools that can provide most of the data you need in monthly or yearly summaries. The ability to drill-down into the details can be helpful to identify any trends that you would like to dig into further.

Some of the basic information you need to analyze your dermatology billing performance includes:

- Charges

- Contractual adjustments

- Collections

- Total accounts receivable (A/R) balance

- Accounts receivable (A/R) aging analysis (0-30 days, 31-60 days, 61-90 days and >90 days)

Step 2: Input Data Into an Analytics Tool

You may need some sort of analytical tool to make sense of your raw data and to tell your practice’s story. With some time and effort, you could build a spreadsheet in a software program like Excel that allows you to input your data and then use formulas to calculate ratios and metrics.

Alternatively, some advanced dermatology practice management systems have built-in analytics reporting and dashboard tools that allow you to easily manipulate and evaluate your practice’s financial data without needing additional software tools.

Alternatively, some advanced dermatology practice management systems have built-in analytics reporting and dashboard tools that allow you to easily manipulate and evaluate your practice’s financial data without needing additional software tools.

Step 3: Measure Key Billing Performance Metrics and Identify Practice Trends

Once you have pulled your data and you have the tools needed to analyze it, the next step is to look at some key billing performance metrics and identify trends in these metrics over time to better understand how your dermatology practice is performing.

- Charges: There are several factors that can impact charges. For example, if a provider takes time off or performs more general procedures versus surgical procedures, charges may be less from one month to another. Not only does this impact the current month’s charges but, perhaps more critical, also the next three months of collections and adjustments.A practice’s fee schedule also can impact charges and adjustments. Higher fee schedules may result in higher charges, but also higher adjustments, and not necessarily more in collections. If you have recently changed your fee schedule, the trend in charges and adjustments may correlate to that change.

- Contractual Adjustments: A contractual adjustment is the amount you write off, or not charge for, due to agreed upon fee schedules with insurance companies. It’s essential to understand what your contractual adjustments are and that they are posted accurately. If a balance is adjusted off, no statements are sent and there is no follow up with the patient, carrier or secondary insurance to get paid what the practice is owed, which can negatively impact your overall cash flow. It’s important to keep track of your contractual adjustments and understand how they impact your practice’s collection metrics.

Step 4: Compare Your Results to Industry Benchmarks

Now that you have calculated your billing metrics, it’s time to review the trends and compare your information to “healthy” ranges for dermatology practices similar to yours. There may be times when your information exceeds the industry benchmarks, which is good; but if your numbers are trending downward it may prompt you to delve deeper and understand why.

MGMA Industry Benchmarks for Key Billing Metrics1

| Net Collection Ratio | 96%-99% |

| A/R Days Sales Outstanding | ≤45 days |

| A/R > 90 days | 12%-15% |

Consider Using a Professional Dermatology Billing Service

Once you’ve completed the steps above and have a clearer picture of trends, challenges and opportunities; it’s time to set financial goals and take action to improve your dermatology billing performance. It’s equally important to continue measuring on a monthly basis, which can take significant effort from you and your staff.

Utilizing a professional medical billing service may be worth considering, to give your practice financials the time and attention needed. With the help of dermatology billing specialists, your practice will be able to closely monitor and trend your key billing metrics, while you and your staff could refocus your time and energy on caring for your patients. Having the right tools and services to measure and manage your billing process may significantly improve the workflow within your practice, as well as potentially increase your financial performance. And after all, that’s the bottom line.

- Collections: Knowing the historical trend and collections total is important, but can be misleading if that’s all you’re looking at. Your collections may have increased—by adding services, physicians, patients, etc.—but you may be working harder, spending more money and not doing as well profit-wise as you think. And this doesn’t even factor increased A/R balances, delayed claims or timely filing issues due if your staff is unable to keep up with the increased patient visits. Your net collection ratio may be a more valuable metric.

- Net Collection Ratio (NCR): This tells you what percentage of adjusted charges (what you’re owed) the practice actually collected. NCR can be measured by dividing your net collections by your adjusted charges. A higher NCR is desirable, but keep in mind it is common to have some “bad debt” or “write off” amount from patients that do not pay.

- Accounts Receivable (A/R): Practices often ask, “How much A/R should we have?” There isn’t one correct answer to this question. Rather, there are a few A/R metrics you should consider to understand your practice’s billing performance.

- A/R Days Sales Outstanding (DSO): A/R DSO measures how many days it takes to collect on what you are owed. A/R DSO is calculated by dividing your A/R by your average sales per day. Higher A/R DSO may be a sign your staff is not submitting “clean” claims, they are not working denials or your payers are taking longer to pay. Payers often provide Electronic Remittance Advices (ERAs) for denied claims, which explains the reasons for denial, helping practices improve their claims processing and get paid faster.

- A/R 0-90 Days, >90 Days: A/R aging buckets help show you where your money is in the collection process. The longer a balance goes unpaid, the more difficult it becomes to collect and the less likely it is to ever get paid. If your older buckets are growing, it could mean your staff is not working the A/R or addressing specific payer issues. Regardless, older A/R requires your attention and a plan to change that trend.

- Feltenberger GS, Gans DN. Benchmarking Success: The Essential Guide for Medical Practice Managers. 2nd Edition. MGMA. 2017