Practice Management Solutions to Help Address Your Finances in Uncertain Times

Practice management solutions to help address your finances in uncertain times.

Since March, CDC guidelines have shifted, moving from reducing the immediate spread of the virus to managing operations during the pandemic. Among the latest recommendations: “reduce the need to provide in-person care.” So, for many practices, the challenge remains: How do we continue to care for our patients, our staff and ourselves, pay off our SBA loans and continue to meet our long- and short-term financial goals? The answer may lie in how practices employ practice management solutions and other methods, like those outlined below, to make the most of the hand they’ve been dealt.

Set and Monitor Your KPIs with Revenue Cycle Analytics

There isn’t just one start line or finish line when it comes to your revenue cycle – there are many. But before you set your markers, you’ll want to see where you stand and define where you want to go – in the long term and the short term. Revenue cycle analytics, preferably the kind that utilizes structured data and customizable A/R reporting, can be an invaluable tool as you begin to take inventory. While there are many metrics to monitor, here are few you’ll want to keep a close eye on throughout the course of the pandemic:

• Accounts Receivable Aging – This metric will tell you how long your invoices have gone without being paid. If your A/R aging shows that invoices are being collected at a slower rate, you’ll want to develop some strategies to get your days in A/R back into the 0-30 day range. This will help you meet filing deadlines and prevent insurance denials.

• Accounts Receivable by Payer and Provider – You’ll want to get as much detail as possible on these metrics. And if you run a practice with multiple locations, you may want to monitor A/R by office as well. Tracking these numbers regularly can help you identify denial trends by payer, provider and location, helping you correct problems in a timely fashion. After all, time IS money.

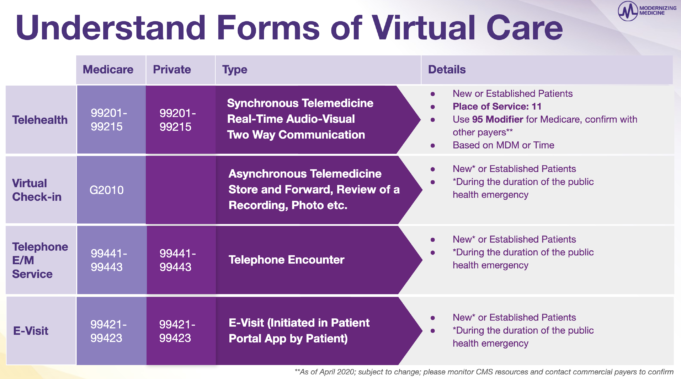

• Reimbursements for Telemedicine – Many of the billing rules and guidelines that govern how providers are reimbursed for the different forms of telemedicine have changed. The information in the chart below is consistent with the Interim Final Rule issued by the CMS on March 30, 2020, which was made effective retroactive to March 1, 2020.

Since the public health emergency, providers have been reimbursed for telehealth (defined as synchronous audio-video calls) as though they had an office visit with their patient. However, providers should use the following codes with place of service 11 and modifier 95 when billing Medicare for services:

• Apply codes 99201-99205 for new patients

• Apply codes 99212-99215 for established patients

Additionally, providers should select telehealth E/M levels based on medical decision-making (MDM) or time (with time defined as the total associated with the E/M on the day of the encounter). These telehealth E/M guidelines are similar to those that will apply to other forms of medical care in 2021.

CMS has also suspended requirements for documenting the patient’s history and/or the physical exam in the medical record for telehealth visits.

We have also outlined above the applicable codes for Virtual Check-In (also known as store-and-forward), telephone encounters and E-Visits. Along with telehealth, practices are permitted to bill these services for both new AND established patients, at least for the duration of the public health emergency.

Streamline Your Patient Registration Process

Doing what you can up front can help your practice prevent claim denials and delayed payments. That means verifying insurance information and correcting errors in advance of patient appointments—and, of course, automating parts of the process if you can. Additionally, patient portals make it easier for patients to check their health information, download forms and make updates to their profile as necessary. Remember: when you make the process easier on patients, they’ll make it easier on you.

Registration is also a great time to talk about patient financial responsibilities. Helping patients understand out-of-pocket costs and co-pays, so that you can potentially collect their payment on the day of their visit, could actually help cut the non-payer side of your revenue cycle down to a single interaction.

Play Offense with Health Insurance Payers

The best way to deal with payers, particularly commercial payers, is to be proactive. Know their guidelines, fee schedules, processes and deadlines, so you can file claims on time and get reimbursed as soon as possible. Here are a few tips to keep your practice on track:

Scrub Those Claims!

Practice management solutions that automatically scrub claims and send them to a clearinghouse for submission can be invaluable in helping to increase your clean claim rate. At Modernizing Medicine®, our clients have achieved an average first-pass claim acceptance rate of 98% with our Practice Management system.

Finalize Visit Notes

Depending on your EHR system, this could be an easy process or one that keeps you up at night – literally. Technology makes all the difference here and investing in a system that’s pre-programmed for your medical specialty, understands your preferences and your workflow, reduces clicks and eliminates excessive data entry, can help you finalize your notes faster, sometimes even before your next appointment.

Assess Your Payer Contracts

Regular and ongoing payer contract management can be key to making sure your practice isn’t leaving money on the table. Here are a few things you’ll want to monitor:

• Contract changes over time

• Payer fee schedules and filing deadlines

• What your payer will cover and what it won’t

• Reimbursement rates

• The process for disputing a denied claim

But most of all, understand your contracts and seize opportunities to negotiate. If you want your physicians to receive higher payment rates, the first step is to ask for them.

Track Medical Claims Statuses

The claims submission process has many steps. As an example of a possible scenario, the first step is to use your practice management system to estimate patient co-pays and balances so your staff can potentially collect from patients upfront (as we explained above). Then, you could use your practice management system to scrub the claim and submit it to your clearinghouse (automatically, if possible). And after that, it’s all about tracking – using your practice management system to check statuses, automate parts of the process, and identify and respond to denied claims, can help pave the way toward the finish line – reimbursement.

Make Patient Payments Convenient

Today, patients are responsible for a larger portion of their healthcare costs, which means outstanding patient bills may comprise more of your revenue stream. And, as we all know, once a patient walks out of your office, they’re less likely to pay you for services. The reasons for not paying vary. Some patients are struggling financially, and for others, when your bill finally arrives by mail, they’ve already forgotten about it. Either that, or they simply don’t check their mail. Regardless of the reason, following up with the patient can make all the difference. It can help your staff assess the patient’s situation and provide the patient with solutions, rather than create additional barriers.

Payment plans and multiple payment options could make the process of paying medical bills easier for patients. These solutions turn a dreaded task involving the purchase of stamps and even a trip to the post office into a simple online visit or even a quick text.

Enlist a Medical Billing Service to Help

There are many variables to consider when you’re trying to address your revenue cycle. We’ve only mentioned a few here. And in addition to everything that’s going on at your practice during normal circumstances – the COVID-19 pandemic has turned everything upside down, creating more volatility and uncertainty. Regulations are in flux, shutdowns are always possible, staff responsibilities are shifting and the virus remains at large. In situations like these, practices have the option to call in the reinforcements, so they can continue to focus on their patients, while working to maintain the financial health of their business.

At Modernizing Medicine, we understand that every practice could use a BOOST right now—modmed® BOOST and modmed gBOOST™ feature a combination of Business Operations Services and practice management software.

With modmed BOOST, you have access to the software and the specialists that can help you address many aspects of your revenue cycle from billing to patient collections, to account reconciliation.

Don’t have time to focus on your revenue cycle or looking for additional practice management solutions? The BOOST team is here to help.

Related Content You May Enjoy

Take your practice to the next level with billing & operations solutions

Get Social With Us

Featured Posts

Topics