Price Versus Value

Is There Such a Thing as an Irrelevant Cost? Can the Cost of Something Actually be LESS than Zero?

Yes! And it’s related to the Price versus Value distinction.

One of Warren Buffett’s favorite quotes is, “Price is what you pay; value is what you get.” It’s a philosophy that guides his investment decisions, and one that has allowed him to achieve enormous wealth.

You see, price is an amount carefully determined by the seller of a good or service while value, on the other hand, is the fundamental importance, worth, or usefulness (utility) derived by the purchaser. Price and value are indeed completely different.¹

Let’s look at a practical example. The price of gasoline at my corner gas station is currently $2.99 per gallon. But the value of that gasoline far exceeds $2.99 per gallon for those who purchase it. For example, that gasoline gets them to and from work each day. That same gasoline enables their children to get to soccer practice, or allows them to visit their loved ones. The value of gasoline far exceeds the $2.99 price.

Now let’s look at how this same concept might apply to business decisions, and how the marginal utility or value (additional value achieved) must be considered over and above the price of something being considered as an alternative. As consumers, we frequently get “hung up” on the price of something. Instead, by focusing on the marginal value that the decision might bring, the actual cost of an item could potentially be muted… and in fact, could even approach a cost of less than zero!

One of the most important decisions that physicians face involves selecting the best electronic health record for their practice. As a consultant for many years, I have seen providers make decisions solely based on price and not value. As a result, the price and cost frequently approximate each other, since marginal value or utility are often ignored. In my experience, this is a common cause of software frustrations. When we ignore value, the cost of the software provides no additional benefits over another competing choice. The software perceptually becomes a fungible commodity, with one choice being equal to another. But in today’s world of advanced technology, that’s simply not the case! You MUST evaluate marginal value.

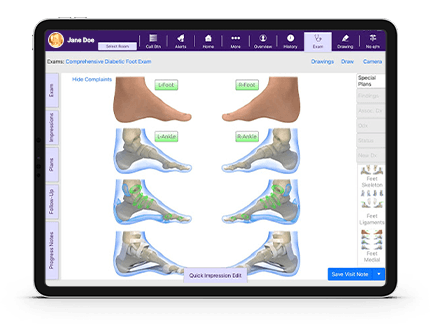

No two electronic health record systems are the same. Instead of focusing solely on price, it’s essential that you ask yourself some questions when evaluating a potential change:

1. Will the change allow for less, very costly resource exhaustion? This added value will allow you to redeploy staff towards more revenue generating opportunities, or perhaps even streamline your payroll.

2. Will the change allow for more efficiency in the charting process? This added value will allow you to spend more focused time with the patient, or will allow you an improved quality of life.

3. Will the change allow for the incorporation of other important processes for which you are currently missing or paying separately for? This added value has a direct financial impact on your practice since it eliminates some of your current costs.

As consumers, we frequently get “hung up” on the price of something. Instead, by focusing on the marginal value that the decision might bring, the actual cost of an item could potentially be muted… and in fact, could even approach a cost of less than zero!

So much like the purchase of a gallon of gasoline, I urge you to think through the perceived price of a good or service and focus on its value. You might indeed find that the marginal price that you pay for a decision, economically, can lead to a cost that is neutral, or perhaps even less than zero!