RCM Tip #11: Benchmark Against Industry Standards

How efficient and effective is your ENT medical billing process?

As an otolaryngologist and practice owner, it’s just as important to keep an eye on your practice’s financial performance, as well as the clinical care you provide your patients. Spending some time to better understand your revenue cycle is essential to maximizing your revenue and planning for long term success.

When it comes to assessing your financial performance, it’s important to benchmark your practice’s results and key metrics against “ideal” ranges for practices similar to yours. This will provide a litmus test of how healthy your revenue cycle is and indicate where you may be able to make improvements in your ENT billing and collections processes.

This month’s revenue cycle management tip will highlight five of the key medical billing metrics you should track and the industry standards you should benchmark against.

1. Days Sales Outstanding (DSO)

Days sales outstanding tells you how long it takes to collect each dollar you’re owed.

DSO is calculated by dividing your outstanding accounts receivable (A/R) by the average sales per day over the last month or longer. According to the Medical Group Management Association (MGMA), DSO of 45 days or less is ideal.1

If your DSO is higher than this benchmark, it could mean your medical claims aren’t going out fast enough or are being submitted incorrectly, resulting in rejections or denials that create more work for your staff and delay your payment.

A high DSO could also indicate that your patients are not paying their bills in a timely manner. A recent survey conducted by HIMSS Analytics found that over 50 percent of patients take longer than 3 months to pay their bill, and only a third of all patient balances are successfully collected. If you have difficulty collecting patient balances, you may want to consider a more proactive approach that includes collecting patient payment in the office or offering more convenient patient payment options.

2. First Pass Clean Claim Acceptance Rate

First pass clean claim acceptance rate is the percentage of medical claims that are accepted for processing by the insurance payer upon first submission, without needing any corrections or edits. Insurance payers can reject claims due to missing or invalid information that is required for processing, such as missing provider information or an invalid insurance ID number. According to the Journal of Medical Economics, the clean claim acceptance rate benchmark for a well-run physician practice should be greater than 90%.

Maintaining a high clean claim acceptance rate requires you to be more thorough in your claims submission. Rejected medical claims need to be corrected and resubmitted to the insurance payer for processing, which can be costly and time-consuming for you and your staff.

3. Claim Denial Rate

Your claim denial rate is the percentage of your medical claims that insurance payers have processed, but have denied payment. Typically claims are denied due to incorrect information or policy ineligibility. According to The American Academy of Family Physicians, the industry standard denial rate is 5-10%, with <5% being ideal.

Like rejected claims, denied medical claims can cost you valuable time and resources to appeal and stay on top of. Additionally, outstanding claims can run into timely filing deadlines, which means insurance payers won’t pay after a certain amount of time from the date of service. If you have a high denial rate, you may need to do a deep dive to better understand the coverage policies of your top payers, as well as verify patient eligibility prior to visits.

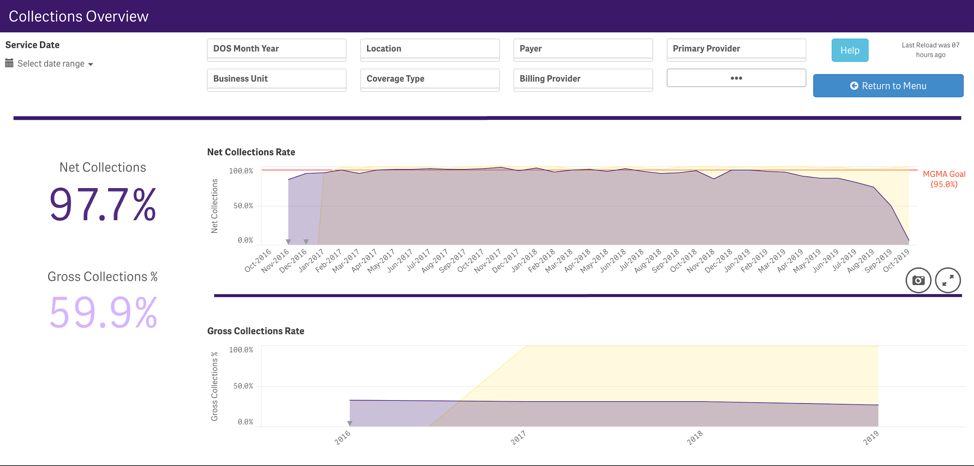

4. Net Collection Ratio

Net collection ratio is a measurement of how successfully you are collecting charges for services that you have billed for. Your net collection ration should account for your payer’s contractual adjustment to charges, so you are truly honing in on the effectiveness of your collections process.

The calculation for net collection ratio is: Net collection ratio = (total collections/net charges)(x100)

MGMA guidelines report that practices with a net collection ratio of 96-97% are effectively collecting charges, while a 95% or below indicates that there may be some room for improvement.1

A low net collection ratio means that your practice is leaving money on the table, and you may need to look into your denials, patient collections, or your outstanding A/R to improve the effectiveness of your collections.

5. A/R Greater Than 90 Days

Account receivable (A/R) is the outstanding balance of money owed to your practice for services that you have billed for. A/R includes outstanding bills due from both patients and insurance payers. Claims may take some time for insurance payers to process, but in general, the longer a claim goes unpaid, the more difficult it is to collect the balance due. A common measurement that medical practices evaluate is A/R, or outstanding balances, that are more than 90 days overdue.

The MGMA benchmark range for A/R greater than 90 days is 12%-15%.1 A higher percentage of A/R that is greater than 90 days means you are less likely to collect payment in full on these outstanding charges, and you may miss out on this hard-earned revenue for good. You may need medical billing staff dedicated to regularly following up on outstanding claims and balances to ensure you are paid timely for your hard work.

How a fully integrated ENT suite of solutions can help you meet your financial goals

These are just a few of the key medical billing metrics you should be monitoring to ensure the financial health of your practice. Running reports and calculating metrics can be a full-time job for your billing or administrative staff. And If you don’t have the right ENT software in place, performing advanced financial analysis can seem like a herculean task.

If you’re like most physician owned practices, in-depth financial planning and other administrative tasks can take a back seat to providing top-notch clinical care to your patients.

Implementing the right ENT software along with a comprehensive ENT billing service can help you keep track of your practice’s financial metrics, and even help you to identify areas of improvement in your ENT billing processes.

How Modernizing Medicine® Can Help With Your ENT Revenue Cycle Management

modmed® BOOST is our all-in-one solution that combines our award-winning practice management software with our business operations services to address the needs of your ENT practice’s entire revenue cycle.

Our easy-to-use practice management system integrates with our ENT EHR system, EMA®, to seamlessly connect your front and back offices. Billing and coding information automatically flows from EMA to Practice Management, streamlining your ENT billing workflow. With various customizable scrub rules that automatically check your medical claims before submission, our clients have been able to achieve a 98% first pass clean claim rate on average in 2019.

Also, built into our Practice Management software, you’ll find a treasure trove of financial reports and dashboards that allow you to easily analyze and visualize your financial metrics. With built-in customization tools, you can even drill-down and filter your data to focus on specific details of your claims processing, accounts receivable, patient balances and more.

With modmed BOOST, experienced ENT billing specialists help you with claims processing and denials and rejection management. To make sure you are performing at the top of your class, your modmed BOOST advisor will continuously monitor your practice’s financial metrics, reviewing them with you regularly and helping you identify opportunities for improvement in your billing processes. Your modmed BOOST team works closely with you and your staff to help speed up your revenue cycle, while offloading manual tasks, so you can focus on your patients.

- Feltenberger GS, Gans DN. Benchmarking Success: The Essential Guide for Medical Practice Managers. 2nd Edition. MGMA. 2017